My Payment Plan

Be sure to immediately sign up for My Payment Plan on the SAME day that you register in order to complete your registration. This must be done for each semester you are registering for!

My Payment Plan is an easy, automatic payment plan provided to students through Nelnet Campus Commerce. This is not a loan program. You have no debt, there are no interest or finance charges assessed and there is no credit check for your payment plan.

Questions about My Payment Plan? Please review our quick facts below, our FAQs or email cashhelp@otc.edu.

Questions about My Payment Plan? Please review our FAQs or email cashhelp@otc.edu.

Quick My Payment Plan Facts

- You must sign up for My Payment Plan the SAME day you register.

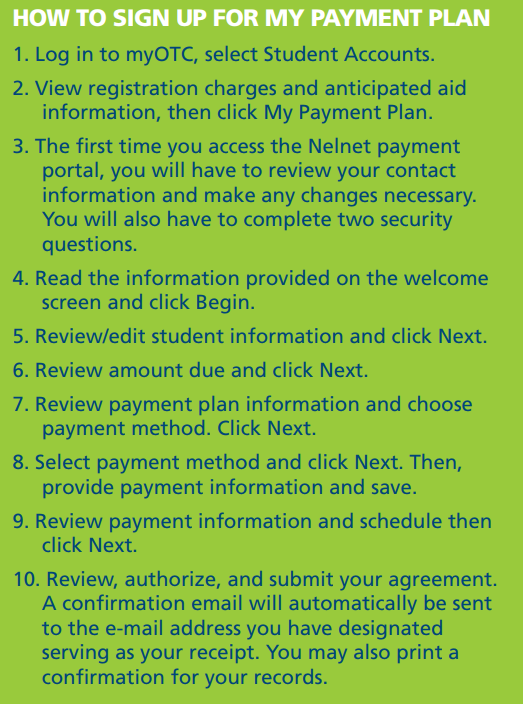

- My Payment Plan is accessed online via your myOTC. Log into myOTC, then select Student Accounts, then select the box that says Click here for My Payment Plan.

- Students: If someone is paying on your behalf, you MUST first set them up as a proxy in your myOTC. Proxy Payers: If you are paying on behalf of a student, the student must establish you as a proxy in their myOTC.

- Proxy information can be found here.

- My Payment Plan must be done every semester, and each plan is good for one semester only.

- Payments are scheduled and automatically attempted.

- Fall scheduled payments: September 5th, October 5th, November 5th

- Spring scheduled payments: February 5th, March 5th, April 5th

- Summer scheduled payments: July 5th, August 5th

- If the 5th payment falls on a weekend or holiday, the payment will be attempted the next possible business day.

- Payment methods allowed:

- Automatic Bank Payment (ACH)

- Credit/Debit Card (Visa, MasterCard and Discover)

- There is no fee to enroll in My Payment Plan. There are no interest charges.

- Nelnet will assess a $15.00 returned payment fee if a payment is returned.

- OTC will assess a $10.00 non-refundable missed payment fee if an automatic payment is unsuccessful.

- Agreements that are terminated prior to the scheduled end of the payment plan are considered defaulted and may incur a $30.00 payment plan default fee.

Below, you will find some additional important information about My Payment Plan.

Monthly payments are automatically deducted on the fifth of each month from the bank account or credit/debit card you provided when setting up My Payment Plan. Payments will continue per the payment plan agreement until the balance is paid in full or shows covered due to anticipated aid. Please note: Check, Debit, and ATM Cards may be returned unpaid due to daily limits and restrictions imposed by your bank. If this happens, OTC is not responsible for any fees incurred.

Automatic Bank Payment (ACH) payments are payments you have authorized to be processed directly with your bank. These payments are simply bank-to-bank transfers of funds that you have pre-approved.

If your payment on the fifth is not successful (missed/returned payment), you will incur a $10.00 missed payment fee assessed by OTC. Nelnet will assess a $15.00 returned payment fee. You may also incur additional fees assessed by your financial institution. Missed payments will not be re-attempted. Your balance owed to the college minus any anticipated aid will be divided among remaining payments. Defaulting on a payment agreement will result in the college assessing a $30 non-refundable NSF Payment Plan default fee.

All students, including students receiving any type of financial aid or assistance must Sign up for My Payment Plan on the SAME day they register. When you sign up for My Payment Plan, you agree to have payments automatically deducted from the checking/savings account or credit/debit card you provide.

If you have a balance on the scheduled monthly payment attempt date, a payment will be taken from your account automatically. Information entered during your payment plan enrollment must be accurate. One wrong number in the checking account or credit card information may result in an invalid agreement. OTC is not responsible for accuracy mistakes.

- Students: If someone is paying on your behalf, you MUST first set them up as a proxy in your myOTC.

- Proxy Payers: If you are paying on behalf of a student, the student must establish you as a proxy in their myOTC.

- Proxy information can be found here.

All steps must be completed in the enrollment process. Carefully read the terms and conditions before submitting the agreement. The system will notify you when you have successfully completed the enrollment and ask you to print a copy of the agreement for your records. You will also receive a confirmation email. Payments are taken on the scheduled payment dates. Payment dates cannot be changed, and automatic withdrawals cannot be stopped by OTC.