Below, you’ll find a list of Finance Office forms, policies and procedures, and finance department contacts for employees.

IMPORTANT INFORMATION FOR OTC EMPLOYEES

GENERAL INFORMATION

Forms

- Advance Travel Request Form – Docusign

- Advance Travel Request “Practice” Form – Docusign

- Allowable Mileage Guidelines

- Car Rental Form/Instructions – Docusign

- Check Request – Docusign

- Check Request – Fillable

- Employee Expense Reimbursement Form

- Equipment Redistribution Form – Docusign

- GL Budget Reallocation Form

- Journal Entry-Department Charge Correction Form

- Synoptix Request Form

Policies, Procedures & Training Guides

- Purchasing Card Manual

- 6.12-Direct Reimbursement for Permissible Expenditures

- GSA Per Diem Rates

- Air Travel Procedures

- Rental Car Procedures & Form – fillable

- Synoptix User Guide

- Chrome River Training Guide – OTC

- Reimbursement Policy & Chrome River Training Video

- Reimbursement Policy & Chrome River Training Presentation PowerPoint.

2024 Reimbursement Policy & Chrome River Training

Contacts

Finance Department & Student Account Services

For all Student Account Services inquiries, call 417-447-4827 or email cashhelp@otc.edu

Jan Schreiber, Administrative Assistant for Finance – ext. 4842

- General Inquires; finance@otc.edu

- Flowers for Employees (death, birth, illness)

- New Vendor Credit Applications

- Sales Tax Exempt Letter

Chris Cannell, Assistant College Director for Finance – ext. 3502

- P-Card Oversight and Training

- Sales & Use Tax Exemption letter & MO form 149 Sales Tax Exemption Certificates

- Journal Entries

- Budget Code Inquiries

- Fund 69 Account Inquiries (student organization accounts)

Beth Minor, Assistant College Director for Finance – ext. 6628

- Grant Oversight; includes travel, check requests, purchase requests

- WSTT (Workforce and Short-Term Training

Kim Thomas, Senior Accountant – ext. 6671

- Grant Budgets & Financial Reporting

Ellen Smith, Grant Accountant – ext. 7785

- RootEd Missouri Grant

- Skill Up Grant

Ashley Bartholomaus, Senior Accountant – ext. 4848

- Bookstore – general finance inquiries

- Café’ – general finance inquiries

- Synoptix – Budget to actual reporting for departments

- Foundation

Angela Gurley-Turpin, Staff Accountant – ext. 2649

- Chrome River (employee expense reimbursement)

- Employee Expense Reimbursement (paper form & Chrome River)

- P-Card Transaction Envelopes – review

Teresa Unzer, Staff Accountant – ext. 4834

- Missouri One Start Up

- JRTP (Job Retention Training Program)

Ben Fuller, Staff Accountant – ext. 2682

- Vendor Management Process (new vendors & vendor updates)

Abby Braden, Staff Accountant – ext. 4829

- Vendor Management Process (new vendors & vendor updates)

- Check Request Approval; including check request DocuSign inquiries

- Employee Expense Reimbursement (paper form & Chrome River)

Sarah Burks, Accounts Payable Specialist – ext. 3519

- Accounts Payable (Check Requests)

- P-card Transaction Envelopes – review

Logan Freres, Accounting Specialist – ext. 4838

- Fixed Assets

TRAVEL REIMBURSEMENT FAQs

General

What is required of an individual prior to travel?

If the travel is only in-state day travel (e.g., driving between OTC locations), there is no documented approval required. If an employee is traveling overnight or out-of-state on college business, the employee should submit an Advance Travel Request (ATR) with all estimated expenses, dates/reason for travel, etc. The ATR will be routed to the appropriate supervisors for review and approval. A completed ATR indicates the travel is approved and sufficient funding is available for estimated expenses. Only after the ATR has been approved should any reservations (e.g., airfare, conference registration) be made.

How far in advance should an employee submit an ATR?

While there is no required date prior to travel for an employee to submit an ATR, it should be completed once it is reasonably anticipated the travel will be occurring. In some instances, this is months in advance, whereas other times this will be a shorter period.

What expenses should I include on my ATR?

Please submit all expenses you expect to pay while on your trip, including registration, lodging, mileage, all meals, parking, local transportation, etc. If you aren’t sure whether you will have an expense (such as you may ride with another employee and therefore not have mileage reimbursement), when in doubt, list the expense on the ATR.

What if I want to stay at a vacation rental (Vrbo, Airbnb, etc) rather than a traditional hotel?

If you want to be reimbursed for an alternate type of lodging, this must be requested on the ATR. Documentation showing the cost of the traditional hotel and the FULL cost of the vacation rental (including all additional fees) must be included when the ATR is submitted for approval.

What do I do to be reimbursed following my trip?

Upon returning, please enter a reimbursement request in Chrome River (accessible under myOTC/Employee Resources) with all expenses for which reimbursement is requested within 30 days of the conclusion of the trip. When submitting a reimbursement, please be sure to:

- Provide a copy of the approved ATR.

- Provide a copy of the conference agenda/program or other documentation supporting the purpose of travel as applicable.

- Provide itemized receipts for all expenses.

- Make comments as appropriate, particularly if an expense(s) or category was higher than expected on the ATR. This helps approvers understand the reason for any differences.

- Please note that, due to the college’s fiscal year end on June 30, any employees traveling in May/June should make a concerted effort to submit reimbursement requests immediately upon returning so the expenses may be recorded in the proper accounting period.

If my actual expenses are higher than those submitted on the approved ATR, will they be denied/rejected?

The ATR is like a budget – while the intent is for it to be as close as possible to actual expenses, it is acceptable if there are variances provided there is a legitimate reason for the difference. If, for example, the employee anticipated needing a ride-sharing (e.g., Uber) ride from the airport to hotel but underestimated the cost, the employee could note in Chrome River why the cost was higher (such as due to the time of day, day of the week, etc.).

Please note the above does not apply to individual meal reimbursements which will be set at the GSA per diem limit by location. Also, expenses that are deemed excessive may be denied by the employee’s supervisor(s), vice chancellor, and/or chancellor.

What are the requirements for reimbursement of expenses for representatives of the college?

Representatives of the college may be reimbursed for actual expenses (e.g., meals, lodging, and other reasonable expenses) provided the expenses are incurred for the benefit of the college. An ATR is not required for reimbursement of expenses to representatives of the college.

Meals

What is the daily limit for meals while I’m traveling?

Individual meal reimbursement for day travel is not permitted (no change from prior policy). Individual meal reimbursement for approved overnight travel is subject to GSA per diem limits. These limits are location-dependent. Please navigate to the GSA per diem webpage (click here) to view the limit for the location to which you’re traveling. Itemized receipts are required.

What if I purchase a meal while in travel mode before I reach my destination?

The GSA per diem limits correspond to your “Primary Destination” where the work activities will take place (attending a conference, presenting research, etc.) Use the “Primary Destination” GSA per diem limits for your entire trip (unless you will be working at more than one destination within the same trip).

What is the daily limit for meals if 1 or more meals is provided by a conference, organization, etc.?

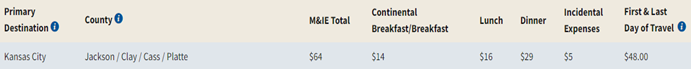

If a meal is provided and does not require the individual to request reimbursement, the allowance for the meal should be deducted from the GSA daily limit. For example, if traveling to Kansas City and the daily limit is $64, but lunch is provided by a conference, then the daily limit would be $64-$16 = $48 (except if this is the first or last day of travel, see next Q&A). See below for GSA per diem reference to example.

What is the daily limit for meals on the first and last day of travel?

Under GSA limits, the first and last day of travel are reimbursed at a maximum of 75% of the full daily limit under the assumption that the individual is eating at least 1 meal (presumably breakfast or dinner) at home. So, in the example of traveling to Kansas City (see above), the maximum allowable would be $48 on both the first and last day notwithstanding any meals provided by a conference, organization, etc.

Is meal reimbursement limited to the daily GSA per diem limit, the individual meal limit, or both?

Meal reimbursement is limited to the daily GSA per diem limit, not the meal limit. For example, if spending the entire day in Kansas City where no meals are provided, reimbursement is limited to a maximum of $64. The college will not require the employee adhere to $14 at breakfast, $16 at lunch, and $29 at dinner (in addition to $5 for incidentals).

How are taxes, gratuities, etc. treated under GSA per diem limits?

Taxes, gratuities (tips), and other such charges (such as service charges) are counted toward the GSA per diem limit.

The college is exempt from Missouri sales tax. Does this apply to sales tax on meals?

No. Employees are not expected to provide a copy of the college’s sales tax exemption certificate to request sales tax on individual meals be waived while traveling on college business. The sales tax exemption is applicable to lodging charges.

What about business meals?

- There has been no change with regard to business meals. Business meals are not subject to GSA per diem limits; however, specific documentation must be provided to Finance to correspond with any business meal. This consists of:

- A list of all participants

- The official purpose of the meeting with, if not clearly evident, the stated benefit to the college.

- An agenda or other such documentation may satisfy both above items.

Please note itemized receipts are required for all business meals.

Transportation

What mode of transportation should I use for my travel?

As stated in Policy 6.12, the employee should use the most economical method of travel considering the time and convenience of the transportation. Of course, this depends on the distance, time, and other factors.

What are the requirements associated with air travel?

When traveling by air, please adhere to the following:

- Reimbursement is only for coach/economy class. If the employee wishes to travel by other means (e.g., business class), the employee is responsible for paying the difference between economy and the upgraded accommodation.

- The college will reimburse for only 1 standard checked bag. Any fees for an additional bag(s) or overweight charges are the responsibility of the employee.

What if the airfare is significantly less expensive if I stay an extra night?

If an employee is requesting to stay an additional night because of airfare cost, the following must be provided at the time the ATR is submitted:

- Copies of airfare costs for the normal day and the extra day for comparison.

- List of all other costs involved with staying an additional night including, but not limited to, lodging, meals, parking, additional local travel costs.

What is the reimbursement rate for mileage?

The college will reimburse employees for actual miles driven for usage of personal vehicles driven on college business at the IRS standard mileage rate at the beginning of the college’s fiscal year (July 1). This rate will be communicated to the college each year.

Please note this does not include mileage driven between a residence and assigned OTC location, which is considered commuting mileage by the IRS and is not reimbursable.

What types of local transportation are permissible?

Taxi, ride-sharing services, and commuter transportation such as bus, shuttle, and train service.

- Itemized receipts are required.

- Ride-sharing receipts must show the date, time, departure location, arrival location, and total cost including tip.

- Additional justification is needed to use reserved ride-sharing services since the cost can be approximately three times the cost of normal ride-sharing services.

Chrome River

How do I add my banking information so I receive an e-check?

Log into myOTC, click on Banking Information. The employee reimbursement bank account has not been added, click on Add an Account button to add your bank information.

Please note, if an Employee Reimbursements bank account is not added, the payment method is a paper check.

How do I log into Chrome River from my computer?

Log into myOTC, click on Employee Resources, and click on Chrome River.

Please note, you can add Chrome River to your favorites so you can access your Chrome River login.

Do I need to enter a user ID and password in Chrome River?

No. Chrome River uses the employee’s Single-Sign-On (SSO) user ID and password.

Do I need to create a separate expense report for each incurred expense (e.g. daily mileage):

No. At the beginning of each month, create an expense report.

- Assign a report name (e.g.: January 2024 Expenses)

- Enter Start & End Date Range (e.g.: 01/01/24 – 01/31/24)

- Enter Trip Departure & Return Time (if entering expenses for the entire month, use your normal work hours (e.g.: 8:00am & 5:00pm)

- Business Purpose: use a generic name for the report cover (e.g.: January Expenses)

- Your expense report – draft is available in the Chrome River “Dashboard”

- As you incur allowable expense, open the draft and use the + button to add expense items (e.g.: mileage, meals, conference registration fee, baggage fee, office supplies, etc.)

- Submit your expense report at the end of each month.

How do I record round trip mileage?

Click the “Return to Start” button.

Traveling to multiple locations in one day?

Click the “Add Destination” button.

I’ve submitted my expense report. How do I know where the report is in workflow?

Click the “Submitted” reports on your Chrome River dashboard. Select the report in question and click the “Tracking” button. This will show the name of the person who has been assigned to approve the expense report.

What does the “Exported” status mean?

Exported means your expense report has been fully approved and has been exported to Colleague. After the weekly check run is fully processed, typically processed on Fridays, the status will change from Exported to Paid.

How do I know when I need to approve an expense report?

An email is generated when an employee submits their expense report.

How do I approve an expense report?

Use the “Approve” button in the email sent to you. Or log into Chrome River on your computer, to approve expense report(s).

Please note, as you review the expense report, the amounts may be adjusted to reflect the allowable limit(s) (e.g.: GSA limits for meals). If the employee did not include required documentation (e.g.: conference agenda, itemized receipt(s), the report can be returned to the employee so they can make the correction.

To return an expense report to an employee, click the “Return” button and add a note of what needs to be corrected. The report will be sent back to the employee to make the correction.

Who can I contact for additional Chrome River questions?

Email questions to chromeriver@otc.edu. This email is monitored by the Finance office.

How do I assign a delegate to my Chrome River app?

Assigning a delegate in the Chrome River app allows someone in your office (such as the Administrative Assistant) to have view access to your Chrome River account.

From the Chrome River dashboard, click on the drop-down arrow next to your name in the upper right corner of the screen. Then select Account Settings. On the left side of the screen, select Delegate Settings. Click the + for Add New Delegates. Start typing the delegate’s name in the box, and then select the name when it appears.

May I use the Chrome River app & the CR Snap app?

Yes. The Chrome River app is used for expense reporting. CR Snap app is used to take pictures of receipts and required documentation. When the CR Snapp app is used, the pictures are stored in the Chrome River Receipt Gallery.